High Freight Charges Affecting Businesses and Consumers

Rizwan Sajan, Founder and Chairman, Danube Group talks about the high freight rate pushing retail prices up, that has been affecting consumers worldwide who are trying to recover from loss in income, business.

Freight rates have quadrupled since the COVID-19 pandemic caused a worldwide lockdown in March 2020, pushing retail prices up, that has been affecting consumers worldwide who are trying to recover from loss in income, business.

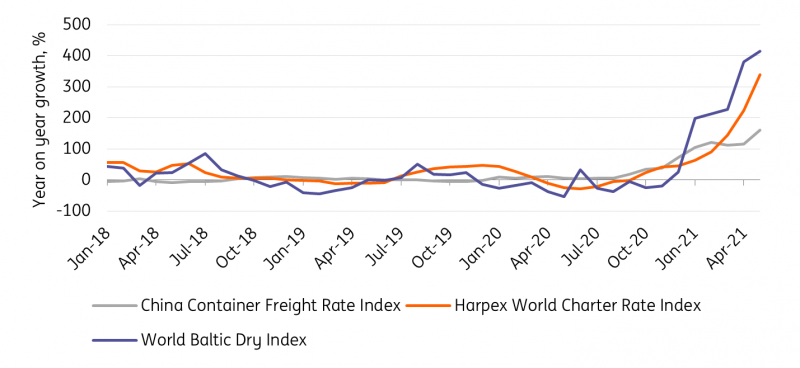

World Dry Baltic Index jumped from – 50 percent in May 2020 to more than 400 percent in May 2021 – an unprecedented increase in a year. China Container Freight Rate Index jumped 170 percent in April this year compared to what it was in July 2020, while Harpex World Charter Rate Index jumped 350 percent in a year from July 2020 to July 2021.

The rate increase was caused by COVID-19 pandemic, which caused a massive decline in trade, resulting a decline in shipments worldwide. Many shipping companies were forced to dock the ships and send the sailors to long holidays. So, when the economic activities resumed after the lockdown, there was a shortage of sailors and other professionals in Autumn 2020.

A combination of factors including soaring demand, a shortage of containers, saturated ports, too few ships and dock workers, have contributed to the situation on almost all the trade routes. Recent COVID-19 outbreak in Asian countries – especially India and China in particular – are worrying.

Transporting a 40-feet container cargo by sea from Shanghai to Rotterdam costs a record US$10,522, a whopping 547 percent higher than the seasonal average over the last five years, according to Drewry Shipping. With more than 85 percent of the goods trade transported by sea, freight rate increase threatens to push up the price of everything from toys, building materials, furniture, auto spare parts and components of all types of goods to tea and coffee – compounding concerns on rising inflation.

Although still relatively minor part of the overall cost of the goods, a research by HSBC Holdings estimates that a 205 percent jump in shipping costs over the past year could increase the Euro-area producer prices by as much as 2 percent. At the retail level, traders are faced with three choices – absorb the cost, pass it on to the consumers or halt trading! Most active traders would pass half of it to their customers and absorb the other half, eventually hitting the bottom line.

What was initially thought as a temporary spike initially, the high freight rate seems to have become the new norm, industry sources say. Although things might change in future, however, the high-rate environment might continue for a year or two, before returning to the pre-COVID-19 situation.

The high shipping expenses are being factored into contracts for the next 12 months, forcing companies to pass the extra costs on to consumers.

There is hardly any sign of relief in the short term, and rates are therefore likely to continue spiking in the second half of this year, as rising global demand will continue to be met with limited increases in shipping capacity and the disruptive effects of local lockdowns, according to a report by economists at ING. Even when new capacity arrives, container liners may continue to be more active in managing it, keeping freight rates at a higher level than before the pandemic, they say.

“Container liners have enjoyed outstanding financial results during the pandemic, and over the first 5 months of 2021, new orders for container vessels reached a record high of 229 ships with a total cargo capacity of 2.2 million TEU. When the new capacity is ready for use, in 2023, it will represent a 6 percent increase after years of low deliveries, which the scrapping of old vessels is not expected to offset,” the report said.

Along with global growth moving past the catch-up phase of its recovery, the coming increase in ocean freight capacity will put downward pressure on shipping costs but won’t necessarily return freight rates to their pre-pandemic levels, as container liners seem to have learned to manage capacity better in their alliances.

In the near term, freight rates may yet reach new highs thanks to the combination of further increases in demand and the constraints of a congested system. And even when capacity constraints are eased, freight rates may remain at higher levels than before the pandemic.

What is the way out? Can someone do something? A decline in port handling charges, customs duty and VAT reliefs by governments could help ease the situation. Ship owners, shipping agencies, freight forwarders could chip in. However, it needs a quick and coordinated response – as soon as possible.