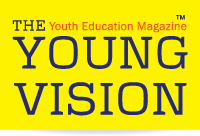

GCC’s Education Sector anticipated to grow at a moderate pace despite challenges, says Alpen Capital report

Dubai, 14th November, 2018: Alpen Capital announced the publication of its GCC Education Industry report. The report provides an outlook of the GCC Education industry until 2022 covering pre-primary, primary, secondary, tertiary and vocational segments across all GCC nations. The report profiles some of the prominent education providers in the region and analyses the growth drivers, trends and challenges faced by the sector.

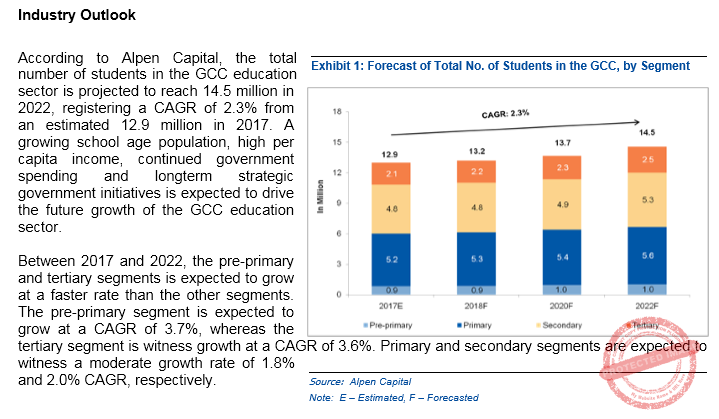

The number of students in private schools is projected to grow at a CAGR of 4.1%, whereas enrolments at public schools is likely to increase at a slower pace, recording a CAGR of 1.3% between 2017 and 2022.

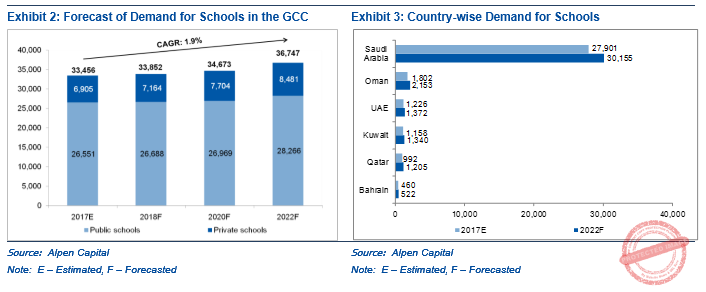

Saudi Arabia is expected to remain the largest education market in the GCC in 2022. In terms of annualized growth, the number of students in Oman and Qatar is projected to grow at a faster rate than the other member nations. The Kingdom of Saudi Arabia is also anticipated to account for the highest number of schools in GCC by 2022.

The demand for public and private schools in the GCC region is likely to increase at a CAGR of 1.9% to 36,747 by 2022, reflecting a requirement of more than 3,200 schools over the next five years. The demand for public schools in the GCC is expected to increase at a CAGR of 1.3% whereas the demand for private schools is anticipated to grow at a CAGR of 4.1% between 2017 and 2022.

Growth drivers

The GCC population is expected to reach 62 million by 2022, growing at a CAGR of 2.3% between 2017 and 2022. A growing school age population continues to foster the demand for education in the region.

High disposable income has increased the propensity for the GCC population to spend on quality education.

The growing preference for private education continues to drive the demand for international schools and universities across the GCC region. Currently, UAE and Qatar are the leading countries with shares of private school enrolments above 60% respectively, however, other regional nations are likely to witness a gradual rise in private sector enrolments.

The education sector has continued to remain one of the significant investment pillars of regional governments. Sizeable budget allocations for the sector and long-term development strategies have contributed towards strengthening the local education system and presenting opportunities for international schools and universities. The GCC governments are also actively seeking to establish public-private partnerships (PPPs) to build a sustainable ecosystem and increase private sector participation through investor-friendly policies to meet the demand of rising student population.

Challenges

The prolonged correction in oil prices led to a number of challenges for the GCC region. This has prompted regional governments to undertake a number of initiatives to focus on fiscal consolidation through subsidy cuts and curtailing public spending. Further, regional governments also introduced measures such as Value Added Tax (VAT) to boost government receipts and reduce fiscal deficits. Hence, the region witnessed a period of consolidation during 2016 and 2017, leading to the scaling back of projects coupled with corporates focusing on cost rationalization amid pressures on top-line. These factors have resulted in a relatively moderate growth for the GCC education market during the past two years.

The influx of international institutions and oversupply of education providers in the GCC region is likely to challenge the sustainability of institutions without a long-term plan. This has led to increasing competition among private operators, resulting in pricing pressures and margin erosion for private operators. The GCC education sector is undergoing rapid changes in teaching styles and adoption of international curricula. Filling the gap of finding the right educators and teachers to address the changing landscape continues to remain a challenge for education providers.

The cost of education in the region is a growing concern for parents and government authorities. Government restrictions on fees hike has increased the pressure on private operators in terms of their ability to spend on infrastructure and resources, deploying technology, and recruiting skilled teachers. The rising cost of education in the GCC is contributing towards the preference of students to go abroad to pursue higher education.

Trends

The reforms and initiatives implemented by regional governments has seen several world class universities establish a base within the region, encouraging students to pursue higher education and a career within the region. The improvement in quality and availability of higher education has resulted in the tertiary segment witnessing the fastest growth in enrolment rates since 2011, registering a CAGR of 8.6% between 2011 and 2016.

Regional governments have undertaken several initiatives to modernize the education system by developing smart learning programs and aligning the education curricula to global teaching standards. The adoption of technology across schools has led to more efficient methods of teaching and in turn delivered an enhanced quality of education.

The shortage of skilled teachers in the GCC has increased the demand for vocational training and education programs. The entry of private institutions and emphasis from the GCC governments to develop their labour force for long term sustainability is expected to drive enrolment rates.

The imbalance between the premium private schools and affordable schools in the region has created the need for the ‘affordable schools’ segment, which provide quality education at affordable prices. With the rise in school fees affecting middle-income earners in the UAE, Abu Dhabi announced a new model of private schools with affordable fees, as part of an economic stimulus package, to be rolled out and completed in the next three years.

To conclude, despite challenging macroeconomic conditions, the GCC education sector continues to grow on the back of favorable demographics and a growing preference for private education. The sector continues to offer considerable investment opportunity for consolidation in the segment.